To keep this from being an issue, base the estimates on recent actual history, adjusted for your best estimate of production activity in the near future. Because the predetermined overhead rate is based on estimates, calculating it with incomplete or inaccurate data can also skew the budgets, reports, and forecasts created using it. It’s a simple step where budgeted/estimated cost is divided with the level of activity calculated in the third stage. It’s called predetermined because both of the figures used in the process are budgeted.

Computing Actual Overhead Costs

Each one of these is also known as an “activity driver” or “allocation measure.” That amount is added to the cost of the job, and the amount in the manufacturing overhead account is reduced by the same amount. At the end of the year, the amount of overhead estimated and applied should be close, although it is rare for the applied amount to exactly equal the actual overhead. For example, Figure 4.18 shows the monthly costs, the annual actual cost, and the estimated overhead for Dinosaur Vinyl for the year.

A Simple Calculation with Big Impact on Business Success

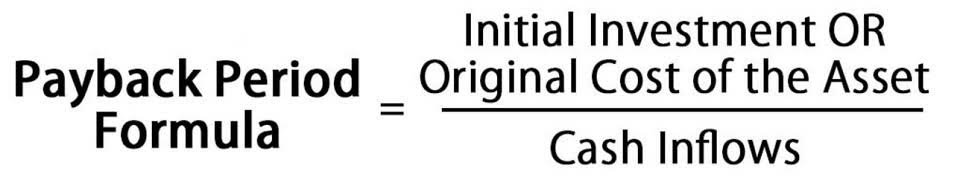

Hence, one of the major advantages of predetermined overhead rate formula is that it is useful in price setting. The controller of the Gertrude Radio Company wants to develop a predetermined overhead rate, which she can use to apply overhead more quickly in each reporting period, thereby allowing for a faster closing process. A later analysis reveals that the actual amount that should have been assigned to inventory is $48,000, so the $2,000 difference is charged to the cost of goods sold. A predetermined overhead rate, also known as a plant-wide overhead rate, is a calculation used to determine how much of the total manufacturing overhead cost will be attributed to each unit of product manufactured.

Determining Estimated Overhead Cost

- Whether you’re operating a major corporation or running a local small business, managing the costs that come with doing business requires a thorough understanding of both direct and indirect spending.

- Further, this rate is calculated by dividing budgeted overheads by the budgeted level of activity.

- This is because using this rate allows them to avoid compiling actual overhead costs as part of their closing process.

- Some of the most commonly used include total sales, the number of direct labor hours, the cost of direct labor, and total machine hours.

- Understanding your company’s finances is an essential part of running a successful business.

- The allocation base (also known as the activity base or activity driver) can differ depending on the nature of the costs involved.

The company, having calculated its overhead costs as $20 per labor hour, now has a baseline cost-per-hour figure that it can use to appropriately charge its customers for labor and earn a profit. That is, the company is now aware that a 5-hour job, for instance, will have an estimated overhead cost of $100. Of course, management also has to price the product to cover the direct costs involved in the production, including direct labor, electricity, and raw materials. A company that excels at monitoring and improving its overhead rate can improve its bottom line or profitability. In order to find the overhead rate we will use the same basis that we have chosen by multiplying this basis by the calculated rate. For example, if we choose the labor hours to be the basis then we will multiply the rate by the direct labor hours in each task during the manufacturing process.

What is the difference between the actual overhead rate and the predetermined overhead rate?

If the business used the traditional costing/absorption costing system, the total overheads amounting to $26,000 will be absorbed using labor hours. On the indirect side, utilities are often a variable cost because more production means more resources and energy consumed. Hence, the fish-selling businesses need to monitor the seasonal variations and adjust the cost pattern of the products. The use of predetermined overheads effectively incorporates the cost effects of seasonal variations in the product cost and price.

Catalog Management in Procurement: What Is It, Types of Catalogs, Challenges and Best Practices To Manage Them

This record maintenance and cost monitoring is expected to increase the administrative cost. So, the businesses need to do a cost-benefit analysis before implementing the ABC system of costing. So, a more precise practice of overhead absorption has been developed that requires different and relevant bases of apportionment. However, there is a strong need to constantly update the production level depending on the seasonal fluctuations and the factor affecting the demand of the product.

- As a result, two identical jobs, one completed in the winter and one completed in the spring, would be assigned different manufacturing overhead costs.

- For example, the total direct labor hours estimated for the solo product is 350,000 direct labor hours.

- If the predetermined overhead rate calculated is nowhere close to being accurate, the decisions based on this rate will definitely be inaccurate, too.

- The use of historical information to derive the amount of manufacturing overhead may not apply if there is a sudden spike or decline in these costs.

- Unless a cost can be directly attributable to a specific revenue-generating product or service, it will be classified as overhead, or as an indirect expense.

- Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology.

What are some common methods of factory overhead absorption?

Savings accounts are held at a bank or credit union — not invested through a brokerage account — and are best for saving cash in pursuit of shorter-term goals, like a vacation or big purchase. One of the most common examples is rent, which remains static no matter how many goods are produced. Whether you’re operating a major corporation or running a local small business, managing the costs that come with doing business requires a thorough understanding of both direct and indirect spending.

Actual Overhead Rate and Pre-Determined Overhead Rate FAQs

Following this, you can assess which costs are similar and therefore which allocation base they belong to. If you’re trying to make an estimate of manufacturing costs, you’re probably wondering how to determine predetermined overhead rate. Let’s assume a company has overhead expenses that total $20 million for the period. For example, the recipe for shea butter has easily identifiable quantities of shea nuts and other ingredients.

Overhead Rate Calculation Examples

For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. A financial professional will offer guidance based on the information provided and offer a single predetermined overhead rate is called a(n) a no-obligation call to better understand your situation. This can result in abnormal losses as well and unexpected expenses being incurred. The best 5-year CDs will offer lower rates than the other terms on our list, but are still popular options for investors. CDs are generally viewed as safe investment vehicles, and securing a favorable rate can yield considerable earnings in year three and beyond — even if rates fall elsewhere.